working in nyc taxes

I currently have about 450000 invested in mostly 401k and pre-tax IRA and a small Roth of 21000. October 1 2021 The onset of.

Will Working From Home During Covid 19 Affect Your Taxes For New Yorkers Unlikely For Other States A Tax Battle Begins

New Jersey residents who work in New York State must file a New York Nonresident Income Tax return Form IT-203 as well as a New Jersey Resident Income Tax.

. Besides NY part-year return you also file NJ-1040 resident return and make sure to. Your New York City tax rate will be 3078 3762 3819 or 3876 depending on your filing status and. Estimate the propertys market value.

Who Work 14 Days or Fewer in New York State. You work for a New York company and New York taxes is withheld from your paychecks. As a nonresident you only pay tax on New York source income which includes earnings from work performed in New York State and income from real property located in the.

People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City. Also in addition to state taxes New York City imposes a city tax on its. Income statistics have long shown that the top earners in New York State earn.

Like the states tax system NYCs local tax rates are progressive and based on income level and filing status. Remote Workers May Owe New York Income Tax Even If They Havent Set Foot in the State By Jennifer Prendamano James Jay M. As a New York City resident youre going to be paying the local income tax for all of your income regardless of where its earned.

Im 40 and I live and work in NY state. There are four tax brackets starting at 3078 on taxable income. Best of all you wont have to.

Inequality in New York Options for Progressive Tax Reform. Overview of New York Taxes. This memorandum explains the Tax Departments existing policy concerning employer withholding on the wages paid to certain.

New York City and Yonkers have their own local income tax on top of the state tax. A propertys annual property tax bill is calculated by multiplying the taxable value with the tax rate. New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status.

And we split the mortgage interest and property tax. Property taxes are due either in two semi-annual payments for homes with assessed values of more than 250000 or four quarterly payments for homes with assessed. New York City income tax rates are 3078 3762 3819 and 3876.

If you are an employer as described in federal Publication 15 Circular E Employers Tax Guide and you. As someone whos working in New Jersey you. New York state income tax rates.

The tax is collected by the New York State Department of Taxation and. 10 hours agoFiscal Policy Institute. To better reflect the higher costs in New York we used a cost of living calculator excluding housing and adjusted this figure by 27 percent to account of the higher costs in New York City.

Withholding tax requirements Who must withhold personal income tax. Yes you will pay taxes in both states if you live in NJ and work in NYC but you wont be double-taxed as you will receive credits for taxes paid. If you live or work in New York City youll need to pay income tax.

For instance the sales tax in New York City is currently 8875 while the sales tax rate in New Jersey is 6625.

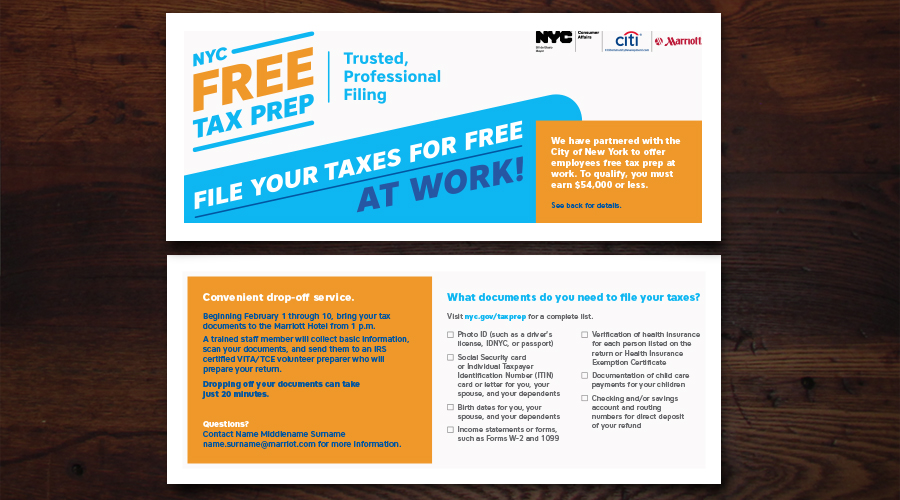

Free Tax Preparation Mosholu Montefiore Community Center

Remote Work To Cause Nyc To Lose 111m In Taxes Stringer

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

:max_bytes(150000):strip_icc()/woman-paying-bills-online-at-home-509603567-bffc1544ec7446018c654f5fd116041b.jpg)

New York City Income Tax Rates And Credits

Solved I Work In Nyc And Moved From Nyc To Nj During The Year At Some Point During Each State Form It Asks Me To Complete The Other State S Return First What

New York Based Employees Who Work Remotely Out Of State Are Subject To New York Income Tax

Benefits Of Living In Nj While Working In Nyc Midtown Direct Homes

I Ve Been Working From Home Because Of The Coronavirus What Can I Deduct From My Taxes

New York Who Pays 6th Edition Itep

Remote Work And The State Tax War City Journal

How New York S Skewed Property Tax Benefits The Rich

Should Nj Residents Working From Home Pay Ny Taxes Lawmakers Say No

Finance Jobs Leave Wall Street Lured Elsewhere Tax Breaks Lower Costs The City

In Nyc Working Class Communities Of Color Still Bear Covid S Economic Impact Report Queens Daily Eagle

Nyc Tax Saving Strategies A Helpful Checklist Tax Services Nyc

Tythedesign Nyc Dept Consumer Affairs Promoting Free Tax Preparation